Breaking the Shackles of Student Debt: Top Strategies for a Debt-Free Future

Student debt has become a pressing concern globally, affecting not only individuals but also the overall economy. The weight of debt can be overwhelming, making it challenging for students to focus on their studies and future careers. However, there is hope. With the right strategies and mindset, students can tackle their debt and create a brighter financial future. In this article, we will explore the top strategies for tackling student debt globally, providing actionable tips and inspiring stories to motivate readers to take control of their finances.

Understanding the Scope of Student Debt

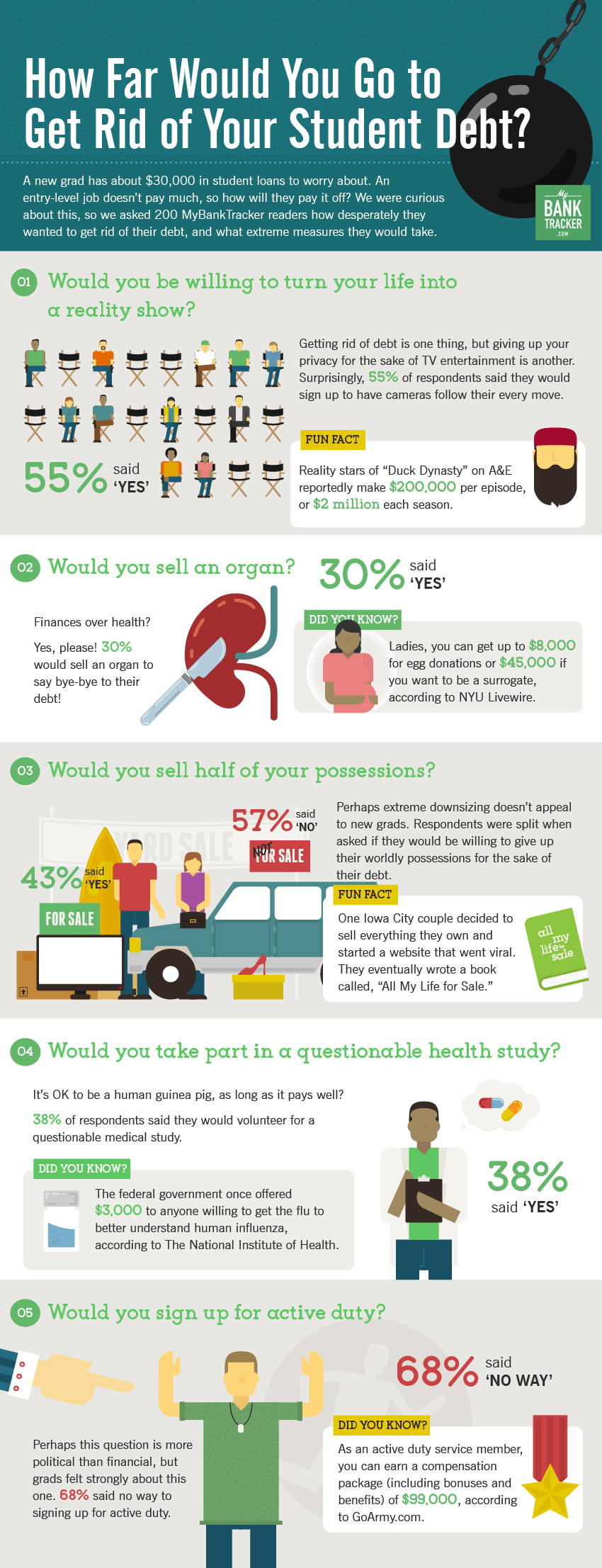

Before diving into the strategies, it’s essential to understand the scope of the problem. According to a report by the Organisation for Economic Co-operation and Development (OECD), the average student debt in developed countries is around $20,000. In the United States alone, student debt has surpassed $1.7 trillion, making it the second-largest type of consumer debt after mortgages.

The impact of student debt goes beyond individual finances; it also affects the economy and society as a whole. A study by the Federal Reserve found that student debt is delaying major life milestones, such as buying a home, getting married, and starting a family. Moreover, the stress and anxiety caused by debt can lead to mental health issues, decreased productivity, and reduced economic mobility.

Strategy 1: Scholarships and Grants

One of the most effective ways to tackle student debt is to avoid it altogether. Scholarships and grants can provide significant financial support, reducing the need for loans. There are numerous scholarships available, catering to various fields of study, demographics, and interests.

To increase their chances of securing a scholarship, students should:

- Research thoroughly: Look for scholarships offered by universities, organizations, and companies. Utilize online resources, such as scholarship search engines and social media platforms.

- Meet the criteria: Ensure they meet the eligibility criteria, including academic performance, extracurricular activities, and community service.

- Submit quality applications: Provide well-written essays, strong recommendations, and accurate documentation.

Strategy 2: Income-Driven Repayment Plans

For students who have already accumulated debt, income-driven repayment (IDR) plans can be a lifeline. IDR plans adjust monthly payments based on income and family size, making them more affordable.

The United States, for example, offers several IDR plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans not only lower monthly payments but also offer forgiveness options after a certain period of time.

To take advantage of IDR plans, students should:

- Research available options: Explore the different IDR plans offered by their government or loan providers.

- Calculate their payments: Use online tools to determine their monthly payments under each plan.

- Apply and reapply: Submit applications annually to ensure continued eligibility and adjust payments as income changes.

Strategy 3: Debt Consolidation and Refinancing

Debt consolidation and refinancing can simplify student loans and reduce interest rates, making them easier to manage.

Consolidation involves combining multiple loans into a single loan with a lower interest rate and a longer repayment period. This can reduce monthly payments and make it easier to keep track of debt.

Refinancing, on the other hand, replaces existing loans with a new loan at a lower interest rate. This can save students thousands of dollars in interest over the life of the loan.

To benefit from consolidation and refinancing, students should:

- Compare rates: Research loan providers and compare interest rates to find the best deal.

- Consider fees: Look for lenders with minimal fees, as these can add up quickly.

- Evaluate repayment terms: Choose a lender with flexible repayment terms and no prepayment penalties.

Strategy 4: Employer-Assisted Repayment

Employer-assisted repayment programs can provide a much-needed boost to students’ debt repayment efforts. These programs, also known as student loan repayment benefits, offer employees a set amount of money each year to put towards their debt.

A survey by the Society for Human Resource Management found that 8% of employers in the United States offer student loan repayment benefits, with an average annual contribution of $1,100.

To take advantage of employer-assisted repayment, students should:

- Research companies: Look for companies that offer student loan repayment benefits during their job search.

- Negotiate benefits: If a company doesn’t offer a student loan repayment program, students can negotiate this benefit as part of their salary package.

- Maximize contributions: Contribute as much as possible to their employer-assisted repayment program to pay off debt faster.

Strategy 5: Financial Literacy and Planning

Financial literacy and planning are crucial in tackling student debt. By understanding personal finances, creating a budget, and developing a repayment strategy, students can make informed decisions about their money.

To become financially literate, students should:

- Take online courses: Utilize free online resources, such as Coursera, edX, and Khan Academy, to learn about personal finance and budgeting.

- Read books and articles: Stay up-to-date with the latest financial trends and advice from experts.

- Seek counseling: Consult with financial advisors or debt counselors to receive personalized guidance.

Strategy 6: Community Support and Accountability

Finally, community support and accountability can play a significant role in tackling student debt. Surrounding oneself with like-minded individuals who share similar financial goals can provide motivation and encouragement.

To tap into community support, students should:

- Join online forums: Participate in online communities, such as Reddit’s r/studentloandebt, to connect with others who are facing similar challenges.

- Attend workshops and events: Take advantage of free or low-cost workshops and events focused on personal finance and debt management.

- Share progress: Regularly share progress with friends and family to stay accountable and motivated.

Conclusion

Tackling student debt requires a combination of strategies, from scholarships and grants to employer-assisted repayment and financial literacy. By understanding the scope of the problem, exploring available options, and taking actionable steps, students can create a debt-free future.

If you’re struggling with student debt, don’t lose hope. There are numerous resources available to support you. Share this article with a friend or family member who may be facing similar challenges, and let’s work together to break the shackles of student debt.

Share this article:

Help spread the word about the top strategies for tackling student debt. Share this article on social media, and let’s create a community of individuals committed to achieving financial freedom.

[Share on Facebook] [Share on Twitter] [Share on LinkedIn] [Share via Email]