The Power of ETFs: Why Understanding Exchange-Traded Funds is Crucial for Savvy Investors

As the world of finance continues to evolve, investors are searching for ways to navigate the complexities of the market and make informed decisions about their investments. One of the most powerful tools at their disposal is the exchange-traded fund (ETF). But are you making the most of ETFs in your investment portfolio? In this article, we’ll delve into the importance of understanding ETFs and explore the benefits and limitations of these popular investment vehicles.

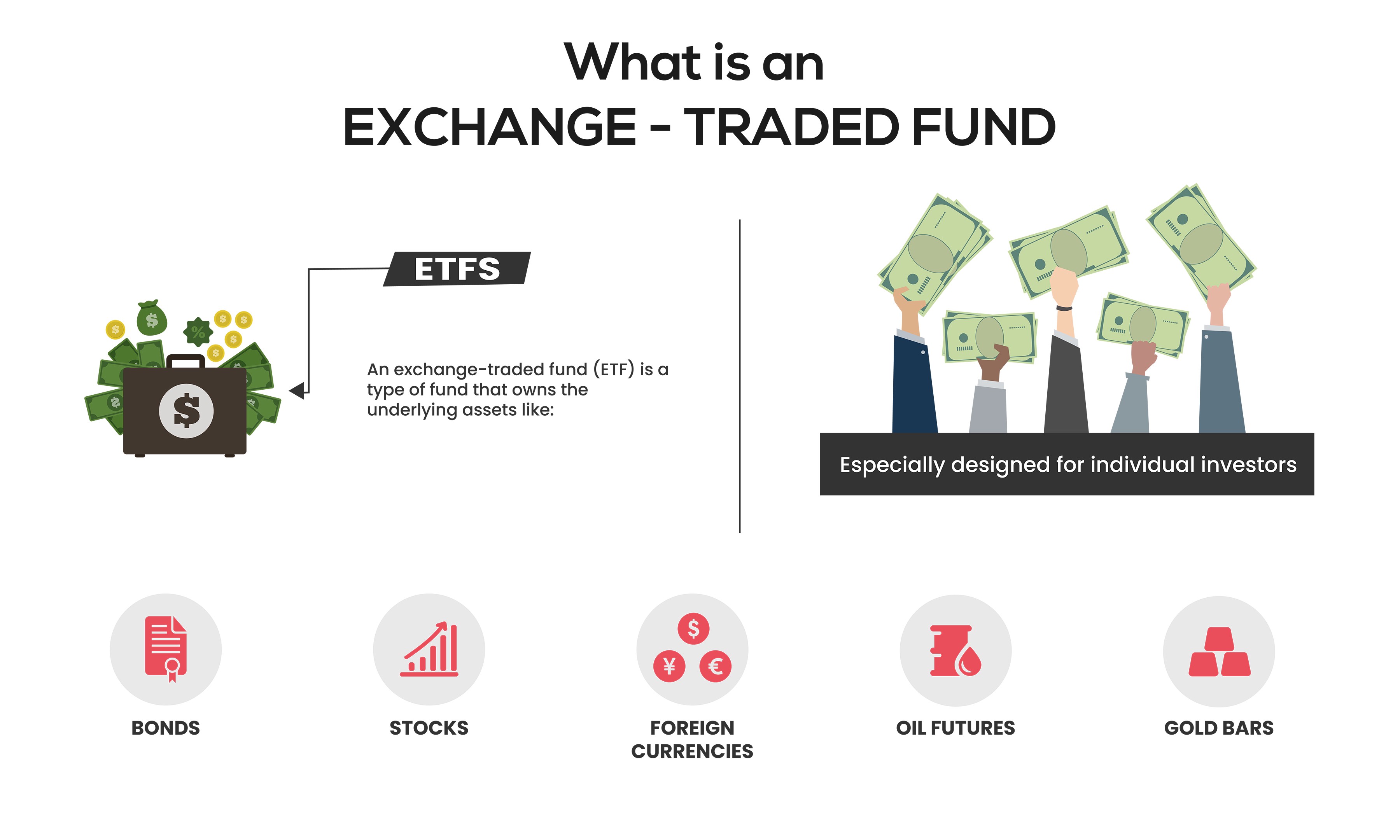

What is an Exchange-Traded Fund?

Before we dive into the importance of ETFs, let’s start with the basics. An exchange-traded fund (ETF) is an investment fund that tracks the performance of a particular index, sector, or asset class, such as stocks, bonds, or commodities. ETFs are traded on major stock exchanges, like the New York Stock Exchange (NYSE) or NASDAQ, and can be bought and sold throughout the trading day.

ETFs are designed to provide investors with exposure to a broad range of assets, often at a lower cost than traditional mutual funds. They typically hold a basket of securities that replicate the performance of a specific index, such as the S&P 500 or the DJIA. This allows investors to gain access to a diversified portfolio with a single ticker symbol.

Benefits of ETFs

So, why are ETFs so popular among investors? Here are some of the key benefits:

- Diversification: ETFs offer investors the opportunity to diversify their portfolio by investing in a broad range of assets, sectors, and geographic regions.

- Flexibility: ETFs can be traded throughout the day, allowing investors to quickly respond to changes in the market.

- Low Costs: ETFs often have lower fees and expenses compared to traditional mutual funds.

- Transparency: ETFs disclose their holdings daily, allowing investors to know exactly what they own.

- Tax Efficiency: ETFs are designed to minimize tax liability, as they do not involve frequent buying and selling of securities.

Limitations of ETFs

While ETFs offer many benefits, they are not without their limitations. Here are some of the key considerations:

- Trading Costs: While ETFs themselves may have low costs, trading them can still involve significant transaction fees.

- Market Risk: ETFs are subject to the same market risks as the underlying assets they track, such as stock market fluctuations or interest rate changes.

- Leverage: ETFs can use leverage, which means that small changes in the market can result in significant fluctuations in the value of the ETF.

- Illiquidity: Some ETFs may trade infrequently, making it difficult for investors to buy or sell their shares quickly and at a reasonable price.

Using ETFs for Tactical Asset Allocation

One of the most effective ways to use ETFs is as a tactical asset allocation tool. This involves actively managing your portfolio by adjusting the allocation of assets based on market conditions and economic trends. By using ETFs, investors can quickly and easily allocate their assets to take advantage of opportunities in the market.

For example, if an investor believes that the stock market is due for a correction, they could use ETFs to allocate their portfolio to fixed income or commodities. Conversely, if they believe that the market is poised for a rally, they could use ETFs to increase their exposure to stocks.

Example ETF Strategies

Here are a few examples of ETF strategies that investors can use to enhance their portfolios:

- Sector Rotation: Use ETFs to rotate between sectors and industries based on market trends and economic conditions.

- Bond Rotation: Use ETFs to rotate between bond sectors, such as government bonds, corporate bonds, or high-yield bonds, based on interest rate and credit spread movements.

- Commodity Rotation: Use ETFs to rotate between commodity sectors, such as energy, gold, or silver, based on supply and demand trends.

Conclusion

In conclusion, ETFs are a powerful tool for savvy investors looking to diversify their portfolios and gain exposure to a broad range of assets. By understanding the benefits and limitations of ETFs, investors can use them to create a more efficient and effective portfolio. Whether you’re a individual investor or an institutional investor, including ETFs in your investment mix can help you achieve your financial goals.

Call to Action

Have you been considering using ETFs in your investment portfolio? Share your thoughts and insights with us in the comments below. What questions do you have about ETFs? We’d love to hear from you!

Share this article with your friends and family who are interested in learning more about ETFs. Together, we can all make more informed investment decisions and achieve our financial goals.