The Power of Rebalancing: Why It’s Essential for Your Investment Portfolio

As investors, we’re always on the lookout for ways to grow our wealth and achieve our financial goals. One crucial aspect of successful investing is maintaining a well-balanced portfolio. Rebalancing your investment portfolio can make all the difference in achieving long-term success, but many investors neglect to do so. In this article, we’ll explore the importance of rebalancing, the benefits it brings, and provide actionable advice on how to do it effectively.

What is Rebalancing?

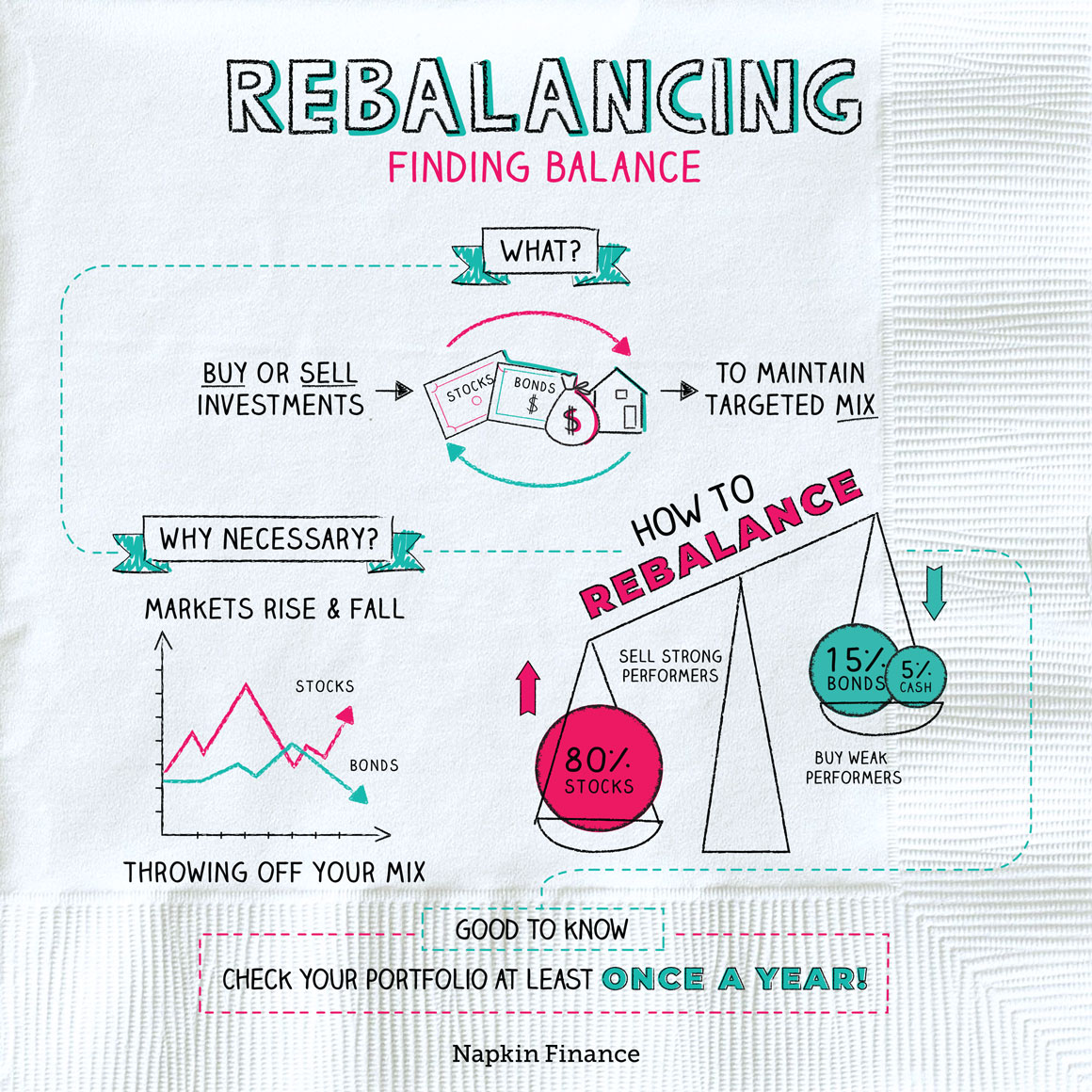

Rebalancing is the process of adjusting your investment portfolio to ensure it remains aligned with your risk tolerance, investment goals, and overall strategy. It involves monitoring your portfolio’s performance and making adjustments as needed to maintain an optimal asset allocation. Rebalancing can be done automatically through a systematic process or manually by periodically reviewing and adjusting your portfolio.

Why Rebalancing is Crucial

Rebalancing is essential for several reasons:

- Maintain Risk Tolerance: A well-balanced portfolio ensures that you’re not over-exposed to any one asset class, reducing your risk tolerance. Rebalancing helps you stay within your comfort zone, protecting your portfolio from significant losses.

- Capital Preservation: Rebalancing enables you to lock in gains and limit losses, preserving your capital for the long term.

- Optimize Returns: By rebalancing, you can optimize your returns by ensuring that your portfolio is invested in the most suitable assets for your risk tolerance and goals.

- Reduced Emotional Decision-Making: Rebalancing helps you make rational decisions, rather than emotional ones, based on market fluctuations.

The Consequences of Not Rebalancing

Failing to rebalance your investment portfolio can have severe consequences:

- Performance Issues: A poorly managed portfolio can lead to underperformance, potentially missing out on returns or suffering losses.

- Increased Risk: Ignoring market fluctuations can result in an over-concentration in a particular asset class, exposing your portfolio to significant risks.

- Emotional Distress: Emotional decision-making can lead to impulsive selling or buying, potentially causing financial stress.

When to Rebalance

So, when should you rebalance your investment portfolio? The answer is simple: regularly. Rebalancing should be a part of your investment strategy, not an occasional task. Consider rebalancing:

- Quarterly: Review your portfolio quarterly to ensure it remains aligned with your goals and risk tolerance.

- When Markets are Volatile: Rebalance when markets experience significant fluctuations, such as during a recession or market downturn.

- After Additions or Withdrawals: When making additions or withdrawals from your portfolio, rebalance to maintain an optimal asset allocation.

How to Rebalance Effectively

Rebalancing can be a straightforward process, but it requires discipline and insight. Here are some actionable tips:

- Monitor Your Portfolio: Regularly track your portfolio’s performance and asset allocation.

- Set Targets: Establish targets for your asset allocation, such as a 60% stocks, 40% bonds mix.

- Sell High, Buy Low: Rebalance by selling performers and buying underperformers, helping to maintain an optimal allocation.

- Consider Professional Help: Engage a financial advisor or use a robo-advisor to help you rebalance and optimize your portfolio.

Conclusion

Rebalancing your investment portfolio is a crucial aspect of successful investing. By regularly reviewing and adjusting your portfolio, you can maintain an optimal asset allocation, manage risk, and optimize returns. Don’t underestimate the power of rebalancing – it can make all the difference in achieving your financial goals. Take action today and start rebalancing your portfolio to secure your financial future.

Share the Importance of Rebalancing with Others!

Have you learned something new about the importance of rebalancing your investment portfolio? Share this article with friends, family, or colleagues who may benefit from the information. Help spread the word about the power of rebalancing and inspire others to take control of their financial futures!