Transforming Financial Services with Machine Learning: A New Era of Efficiency and Risk Management

The financial services industry has undergone significant transformations in recent years, driven by advancements in technology, changing regulatory requirements, and shifting consumer behaviors. One of the key drivers of this transformation is machine learning (ML), a subset of artificial intelligence (AI) that enables computer systems to learn from data and make decisions without being explicitly programmed.

In this article, we will delve into the world of machine learning in financial services, exploring its applications, benefits, and challenges. We will also examine the various ways in which ML is transforming the industry, from risk management to customer experience.

The Rise of Machine Learning in Financial Services

Machine learning has been gaining traction in the financial services industry for several years, driven by its ability to process large volumes of data and identify patterns that may not be apparent to humans. From credit risk modeling to portfolio optimization, ML algorithms are being used to improve decision-making and drive business value.

According to a report by McKinsey, the use of AI and ML in financial services is expected to grow significantly in the coming years, with the sector potentially generating an additional $1 trillion in value by 2025. Similarly, a report by Accenture found that 93% of financial institutions plan to increase their use of AI and ML in the next two years.

Applications of Machine Learning in Financial Services

Machine learning has a wide range of applications in financial services, including:

- Risk Management: ML algorithms can analyze vast amounts of data to identify potential risks and opportunities, enabling financial institutions to make more informed decisions.

- Portfolio Optimization: ML can help optimize investment portfolios by predicting asset performance and identifying potential risks.

- Customer Experience: ML-powered chatbots and virtual assistants can provide personalized customer experiences and improve service efficiency.

- Compliance: ML can help financial institutions comply with regulatory requirements by analyzing data and identifying potential compliance risks.

- Cybersecurity: ML-powered systems can detect and prevent cyber threats in real-time, protecting sensitive customer data.

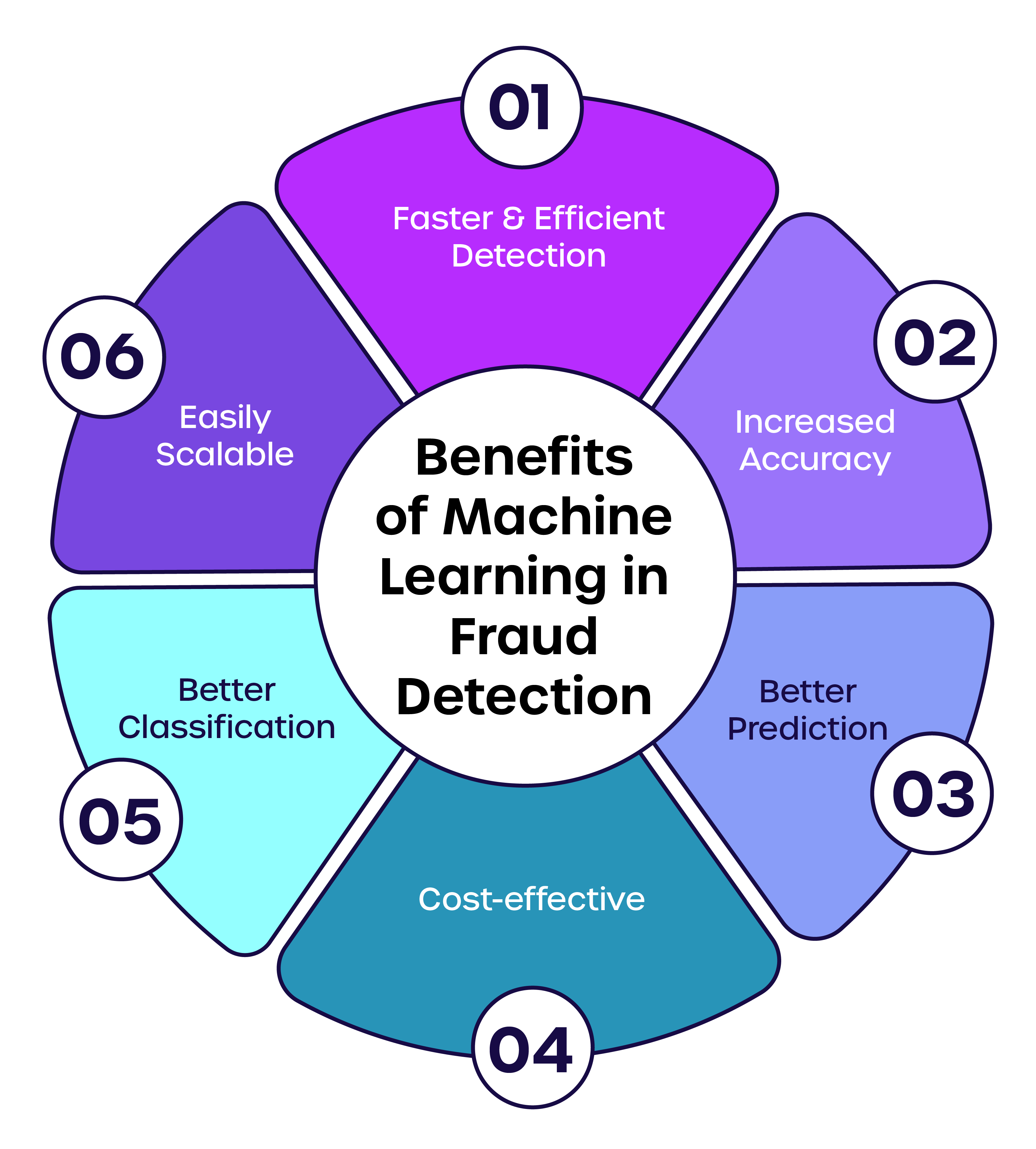

Benefits of Machine Learning in Financial Services

The benefits of machine learning in financial services are numerous, including:

- Improved Accuracy: ML algorithms can analyze vast amounts of data to make more accurate predictions and recommendations.

- Increased Efficiency: ML-powered systems can automate routine tasks and processes, freeing up staff to focus on more high-value tasks.

- Reduced Costs: ML can help reduce compliance and operational costs by identifying areas for improvement and streamlining processes.

- Enhanced Customer Experience: ML-powered chatbots and virtual assistants can provide personalized customer experiences and improve service efficiency.

- Competitive Advantage: Financial institutions that adopt ML can gain a competitive advantage over their peers, improving their market position and revenue streams.

Challenges of Implementing Machine Learning in Financial Services

While the benefits of machine learning in financial services are numerous, there are several challenges that need to be addressed, including:

- Data Quality: ML algorithms require high-quality data to function effectively, but data quality issues can significantly impact performance.

- Model Explainability: ML models can be difficult to interpret, making it challenging to understand why certain decisions were made.

- Regulatory Compliance: Financial institutions need to comply with regulatory requirements when implementing ML, which can be complex and time-consuming.

- Talent Acquisition: ML requires specialized talent, which can be difficult to find and retain.

- Cybersecurity: ML-powered systems can be vulnerable to cyber threats, requiring robust security measures to protect sensitive customer data.

Best Practices for Implementing Machine Learning in Financial Services

To overcome the challenges and maximize the benefits of machine learning in financial services, organizations can follow these best practices:

- Develop a Clear Strategy: Establish a clear ML strategy that aligns with business objectives and priorities.

- Invest in Talent Acquisition: Acquire specialized talent in ML and data science to drive innovation and improvement.

- Develop a Strong Data Infrastructure: Invest in high-quality data infrastructure to support ML initiatives.

- Monitor and Evaluate Performance: Regularly monitor and evaluate ML performance to identify areas for improvement and measure success.

- Foster a Culture of Innovation: Encourage a culture of innovation and experimentation to stay ahead of competitors.

Conclusion

Machine learning is transforming the financial services industry in profound ways, from risk management to customer experience. While there are challenges to be addressed, the benefits of ML are numerous, and organizations that adopt ML can gain a competitive advantage over their peers.

As we move forward in this new era of financial services, it is essential to stay agile and responsive to changing requirements and technologies. By embracing machine learning and following best practices, financial institutions can drive business value, improve customer experiences, and stay ahead of the curve.

Call to Action: Share this article with your network to spark conversations about the transformative power of machine learning in financial services. We’d love to hear about your experiences and insights on this topic in the comments below.