The Power of Dollar-Cost Averaging: A Game-Changer for Global Investors

As a global investor, navigating the complex world of finance can be daunting. With so many options and strategies available, it’s easy to feel overwhelmed and unsure of which path to take. One strategy that has gained popularity in recent years is dollar-cost averaging, a simple yet powerful technique that can help you achieve your long-term investment goals. In this article, we’ll explore the benefits of dollar-cost averaging and how it can revolutionize your investing approach.

What is Dollar-Cost Averaging?

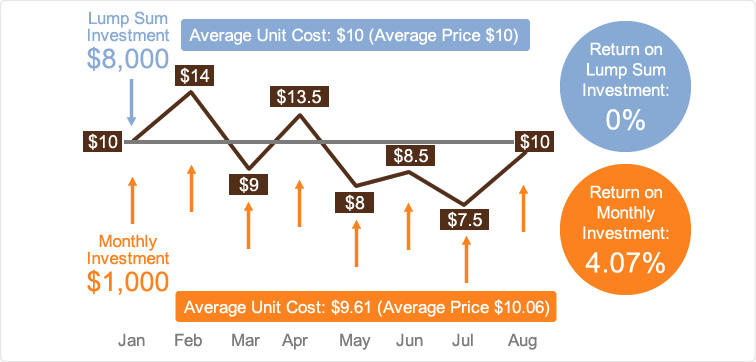

Dollar-cost averaging is a technique where you invest a fixed amount of money at regular intervals, regardless of the market’s performance. This means that you’ll be buying more shares when the market is down and fewer shares when it’s up. The idea behind this strategy is that by averaging your costs over time, you’ll reduce the impact of market volatility on your investments.

Benefits of Dollar-Cost Averaging

So, why is dollar-cost averaging a game-changer for global investors? Here are just a few of the many benefits:

- Reduces Emotional Trading: One of the biggest challenges for investors is emotional trading. When the market is volatile, it’s easy to make impulsive decisions based on fear and greed. Dollar-cost averaging takes the emotion out of investing, allowing you to stay focused on your long-term goals.

- Smooths Out Market Volatility: By investing a fixed amount of money at regular intervals, you’ll be cushioning the impact of market fluctuations. This means that even if the market has a significant decline, you’ll still be investing consistently, taking advantage of lower prices.

- Increases Consistency: Consistency is key to successful investing. Dollar-cost averaging ensures that you’re investing a fixed amount of money at regular intervals, regardless of the market’s performance. This consistency will help you build wealth over time.

- Helps to Avoid Overpaying: When you invest at the peak of a market, you risk overpaying for your investments. Dollar-cost averaging prevents this from happening, as you’ll be buying more shares when prices are lower.

- Tax-Efficient: Dollar-cost averaging can also be a tax-efficient strategy. Since you’re investing a fixed amount of money at regular intervals, you’ll avoid the need to sell shares during times of high market stress, which can trigger capital gains taxes.

Real-World Examples

To illustrate the power of dollar-cost averaging, let’s consider a real-world example. Imagine you invest $1,000 per month in a diversified stock portfolio for 10 years. Here’s what your investment might look like:

- Year 1: The market declines by 10%, and you buy 100 shares for $1,000.

- Year 2: The market recovers, and you buy 90 shares for $1,000 (due to the market’s growth).

- Year 3: The market declines by 5%, and you buy 105 shares for $1,000.

- And so on…

By the end of 10 years, you’ll have invested a total of $120,000 and owned a significant number of shares. But here’s the key point: the average cost of those shares will be significantly lower than the current market price. This means that even if the market declines, you’ll have a diversified portfolio with a lower average cost, increasing your potential for long-term returns.

Conclusion

Dollar-cost averaging is a simple yet powerful strategy that can help global investors achieve their long-term investment goals. By reducing emotional trading, smoothing out market volatility, increasing consistency, helping to avoid overpaying, and providing tax-efficiency, this strategy can revolutionize your investing approach. Remember, dollar-cost averaging is not a get-rich-quick scheme; it’s a long-term strategy that requires patience and discipline.

What Can You Do Next?

Take the first step towards implementing dollar-cost averaging in your investment strategy today! Start by:

- Researching reliable investment vehicles, such as index funds or ETFs

- Setting a fixed investment amount and schedule

- Automating your investments to ensure consistency

- Monitoring your progress and adjusting your strategy as needed

Share this article with a friend or family member who’s looking to improve their investment strategy. Together, we can empower global investors to achieve financial freedom through the power of dollar-cost averaging.